Table of Contents

Introduction

Buying real estate in Mexico as a foreigner can be a rewarding investment, offering access to vibrant culture, stunning beaches, and favorable living costs. However, one critical aspect of this process that often raises questions is the fideicomiso, a legal structure essential for foreigners purchasing property in Mexico’s restricted zones. In this comprehensive guide, we’ll explore everything you need to know about the fideicomiso, its benefits, and how it works when buying real estate.

Understanding the Fideicomiso

What Is a Fideicomiso?

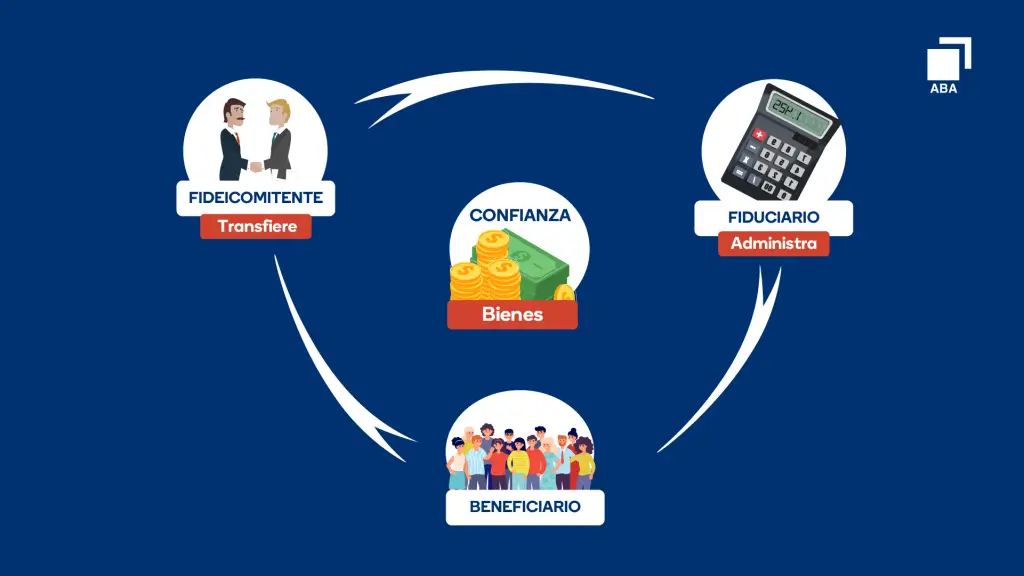

A fideicomiso is a legal trust agreement that allows foreign nationals to purchase and hold residential property in Mexico’s restricted zones. These zones include land within 50 kilometers (31 miles) of the coast and 100 kilometers (62 miles) of international borders. Mexican law restricts foreigners’ direct ownership of land in these areas, but the fideicomiso provides a secure and flexible alternative.

The Legal Basis

The fideicomiso was established following a constitutional amendment in 1973 and further refined in the 1990s. Article 27 of the Mexican Constitution outlines the restrictions on foreign ownership but permits trusts to bypass these restrictions.

Under the fideicomiso structure, a Mexican bank acts as the trustee, holding the title to the property on behalf of the foreign buyer, who is designated as the beneficiary. The foreign owner retains all rights to use, lease, and sell the property, essentially holding the same rights as a direct owner.

How the Fideicomiso Works

- Creation of the Trust: A foreign buyer contracts a Mexican bank to establish the fideicomiso.

- Trustee Role: The bank holds legal title to the property but does not control its use or management.

- Beneficiary Rights: The foreign buyer retains complete control over the property as the trust’s beneficiary.

The fideicomiso typically lasts 50 years and is renewable indefinitely, ensuring long-term security for foreign property owners.

Why Use a Fideicomiso? Benefits for Foreign Buyers

1. Legal Ownership and Security

The fideicomiso provides a legally recognized framework for foreigners to acquire real estate in restricted zones while adhering to Mexican law. The beneficiary holds enforceable rights to the property, offering peace of mind.

2. Flexibility

Through the fideicomiso, the beneficiary can:

- Lease the property for rental income.

- Sell or transfer the property to a third party.

- Bequeath the property to heirs through inheritance.

The trust structure allows beneficiaries to manage and capitalize on their investment without interference.

3. Protection Against Legal Challenges

The involvement of a reputable Mexican bank as the trustee adds a layer of oversight and legitimacy. This minimizes the risk of legal disputes or fraudulent claims on the property.

4. Inheritance Planning

The fideicomiso facilitates inheritance planning by allowing the designation of substitute beneficiaries. The substitute beneficiaries automatically assume ownership upon the beneficiary’s passing, bypassing lengthy probate processes.

5. Indefinite Renewal

A fideicomiso can be renewed indefinitely, ensuring that ownership remains secure for future generations.

The Process of Setting Up a Fideicomiso

Step 1: Identify the Property

Before establishing a fideicomiso, you must identify the property you wish to purchase. Ensure it is located within a restricted zone and conduct due diligence to confirm clear title and absence of liens.

Step 2: Engage a Real Estate Professional

It is crucial to work with a licensed real estate agent familiar with Mexican property laws. They will guide you through the process, help negotiate terms, and liaise with legal experts.

Step 3: Hire a Notary Public

In Mexico, a notary public (notario público) is a government-appointed legal professional overseeing real estate transactions. They ensure compliance with Mexican laws, verify documents, and register the fideicomiso with the Public Registry.

Step 4: Select a Trustee Bank

Choose a Mexican bank to act as the trustee for your fideicomiso. Standard options include large, reputable institutions such as:

- BBVA Bancomer

- Banorte

- HSBC

- Scotiabank

The bank will draft the fideicomiso agreement and hold the title on your behalf.

Step 5: Draft and Sign the Fideicomiso Agreement

The fideicomiso agreement outlines:

- The beneficiary’s rights.

- The trustee’s obligations.

- Renewal terms.

- Designated substitute beneficiaries.

Both parties sign the agreement in the presence of the notary public.

Step 6: Register the Trust

The notary public registers the fideicomiso with the Public Registry of Property and the National Foreign Investment Registry, finalizing the process.

Costs Involved in a Fideicomiso

While the fideicomiso is a convenient legal tool, it does come with associated costs. Understanding these expenses helps you plan your investment effectively.

1. Setup Fees

- Initial setup costs typically range from $1,000 to $2,000 USD, depending on the trustee bank and the property’s value.

2. Annual Trustee Fees

- The bank charges annual maintenance fees, usually between $500 and $1,000 USD. These fees cover administrative expenses and trustee services.

3. Notary and Legal Fees

- Fees for the notary public and legal counsel can vary but typically account for 1% to 2% of the property value.

4. Registration and Tax Fees

- Registration with the Public Registry and National Foreign Investment Registry involves additional fees, totaling $500 to $1,000 USD.

Legal Considerations and Common Questions

1. Can a Fideicomiso Be Transferred or Sold?

Yes, the fideicomiso allows for property transfer or sale. The buyer can either assume the existing fideicomiso or establish a new trust.

2. What Happens if the Trustee Bank Fails?

In the unlikely event of a bank failure, the fideicomiso remains valid. The property title is not part of the bank’s assets, and the trust can be transferred to another bank.

3. Can I Cancel a Fideicomiso?

A fideicomiso can be canceled if you sell the property to a Mexican citizen or move the title to a Mexican corporation.

4. Are There Alternatives to the Fideicomiso?

Foreigners can also acquire property through a Mexican corporation, particularly for commercial purposes. However, this option is more complex and not ideal for personal residences.

5. Is a Fideicomiso Safe?

Yes, the fideicomiso is a legally secure and widely used mechanism, with thousands of foreign buyers successfully owning property through this structure.

Conclusion

The fideicomiso is essential for foreign investors seeking to purchase real estate in Mexico’s restricted zones. By offering legal security, flexibility, and long-term ownership rights, the fideicomiso allows foreigners to enjoy the benefits of Mexican property ownership while complying with local regulations. Although the process involves setup and maintenance costs, the advantages far outweigh the expenses for most buyers.

Whether you’re looking for a vacation home, a retirement destination, or a long-term investment, understanding the fideicomiso is the key to confidently navigating the Mexican real estate market. By partnering with experienced professionals and conducting thorough due diligence, you can make your dream of owning property in Mexico a reality.

Don’t hesitate to contact us for further information about Our Properties in the Mayan Riviera. We can be reached in México (+52) 984 128-4123; you can also send us a message through this Whatsapp link or send an e-mail at info@mayanrivieraliving.mx. We are certified real estate agents. We will save you time, money, and hassle!